Initiative Aiding Williamsburg Homebuyers Likely to Get $900K in COVID Relief Funds

William and Mary may also join local partnership to offset rising costs for buying a new home

The Williamsburg City Council is scheduled to review a proposed partnership with C&F Mortgage during a work session on Monday, February 9, 2026, at 4:00 p.m. at the Stryker Center. The proposal is intended to expand access to homeownership through grants and mortgage-related credits and builds on an earlier City Council decision to dedicate $900,000 in COVID/ARPA relief to affordable housing initiatives. Meeting agenda materials indicate that the College of William and Mary may also contribute to the program to help faculty and staff become homeowners.

According to the City, C&F Mortgage expressed interest last year in supporting local affordable housing efforts. Discussion led to the proposed partnership with a projected total value of $2.7 million. The plan includes the City’s $900,000 allocation, along with two additional $900,000 contributions that have not yet been formally committed—one from the College of William & Mary and another organization identified in C&F materials as the “City Foundation.” In the submitted presentation, C&F frames the effort as a longer-term strategy to build community understanding and support incremental increases in homeownership rather than an immediate fix for affordability.

According to their website, locally-based C&F Financial Corporation has served Virginia communities since 1927, and operates subsidiaries including C&F Mortgage Corporation that provide banking, mortgage, lending, and wealth management services across Virginia and the Mid-Atlantic region.

Williamsburg City Manager Andrew Trivette addressed the new program at a recent meeting of the Planning Commission. “I’m pretty excited to tell you that after many years of trying to find financial partners in the community to help us implement some of those recommendations, we now have a bank that is very interested. I’ve been working with them, along with the mayor, for probably four months to structure a series of programs that address many of the recommendations that were still on that list that we had not tackled,” Trivette told commission members. “I think at the end of the day City Council will be pretty pleased … especially considering this is not a huge sum of money spread across so many programs,” Trivette said.

Program benefits

The mortgage lender identifies interest rates and down payment requirements as key barriers, noting that 30-year fixed rates currently range from 6.0% to 6.5% and that National Association of Realtors data shows median down payments of 12% for all buyers and 6% for first-time buyers. The proposed “Williamsburg Way Home” program would provide financial assistance to homebuyers, especially those purchasing their first home, through multiple components, including:

C&F lender credit:

Up to $5,000 per mortgage loan, equal to a 0.5% lender credit, to help reduce upfront closing costs.

Bankrate defines a lender credit as funds provided by a lender to offset closing costs in exchange for a higher mortgage interest rate, which lowers upfront expenses but increases total costs over the life of the loan.

For example, closing costs typically range from 2% to 5% of a mortgage; for a $300,000 loan, this can equal $6,000 to $15,000 in upfront costs.

Grant programs:

Grants ranging from $5,000 to $10,000 per recipient, funded through the City’s allocated housing funds (or potentially from W&M or other community sources)

Grants could be used for down payment assistance or interest rate buydowns.

City grants could be combined with the C&F lender credit and other available assistance programs.

The City can set restrictions and establish repayment terms.

Grant amounts could vary based on City priorities within its affordable housing strategy.

Access to existing assistance programs:

Increased awareness of down payment assistance programs offering up to $20,000 and interest rate buydowns.

Participation would be subject to borrower eligibility requirements.

Grants would be awarded on a first-come, first-served basis until funds are exhausted.

Affordable Housing Workgroup findings

The City positions the proposal as a part of its broader affordable housing strategy, which is heavily guided by a 2021 report conducted by an Affordable Housing Workgroup. The 15-member committee commissioned a housing study by Dr. Sarah Stafford from the College of William & Mary. That analysis found that approximately 1,600 households—about one-third of all households in the city—are cost-burdened, spending more than 30% of their income on rent and utilities. It also identified a current shortage of 1,247 affordable housing units, projected to grow to 1,640 units by 2040, and noted that fewer than 10% of people employed in Williamsburg live within city limits.

After nine months of meetings, the group reduced roughly 80 potential actions to 13 considered most achievable. These were then ranked to determine the top priorities for the City of Williamsburg:

Hotel to Affordable Housing Conversion: Expanding the Planned Development Housing District (PDH) to allow more hotels to convert into affordable apartments. This was projected to potentially create up to 843 new units.

Triangle Redevelopment: Redeveloping the Triangle Building and the Blayton Building (currently public housing) into a mixed-income, mixed-use district similar to Prince George Street, aiming to create 200 new units while preserving 34 existing ones.

Workforce Housing at Waller Mill: Constructing approximately 35 workforce housing units on city-owned land near the Waller Mill Reservoir using low-impact design principles.

Mixed-Income/Mixed-Use Plan (Capitol Landing Road): Implementing design requirements or zoning amendments to ensure new commercial developments on Capitol Landing Road include affordable residential units.

Rehabilitation Grants: Applying for Community Development Block Grants (CDBG) to fund neighborhood-scale renovations, preserving existing affordable housing stock (estimated 147 units).

Inclusionary Zoning: A policy requiring or encouraging (via bonuses) the inclusion of affordable units within market-rate developments.

Two-Story Development Requirement: Mandating at least two stories for new structures to increase density and provide space for housing above commercial areas.

Soft Density: Allowing duplexes in areas currently zoned only for single-family detached homes to increase housing options.

Affordable Accessory Units: Permitting detached accessory dwelling units (ADUs) on owner-occupied properties.

Community Land Trust: A model where a trust owns the land and sells the structure to the homeowner, significantly lowering the purchase price.

Impact/Linkage Fees: Imposing fees on new residential or commercial developments to generate a funding stream for affordable housing projects.

PPP Loan Consortium: A partnership between for-profit and non-profit entities to pool funds for financing affordable housing projects.

Employer-assisted housing benefit: Program for William & Mary faculty and staff to help recruit and retain employees in a high-cost market.

Centralized campaign

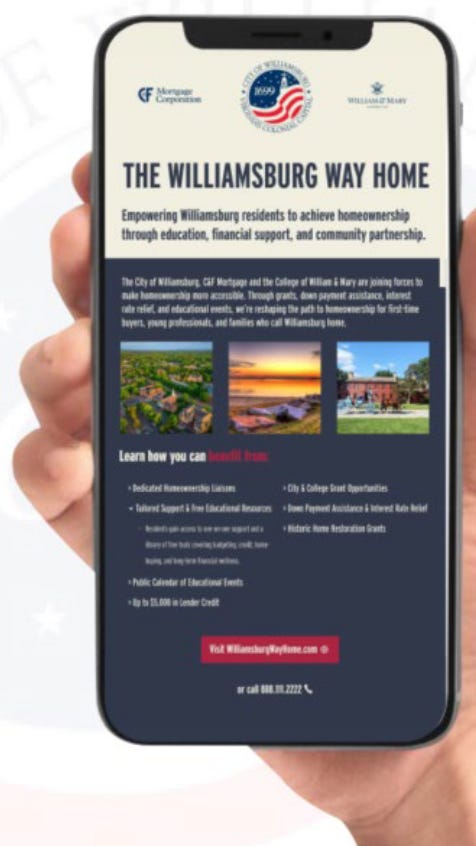

C&F Mortgage Corporation proposes a coordinated marketing and support initiative known as “The Williamsburg Way Home,” intended to centralize homeownership resources for residents of the city looking to purchase their first home. According to C&F, the campaign would unify efforts by the City of Williamsburg, William & Mary, and C&F Mortgage under a single brand and messaging platform. A centralized website, linked from all partner sites, would serve as the primary point of contact and call to action across all marketing channels, with content developed collaboratively by the partners.

The proposal outlines a range of resident supports, including access to dedicated homeownership liaisons, one-on-one assistance by phone or email, and a library of free educational materials covering credit, budgeting, the homebuying process, loan documentation, down payment assistance, and long-term homeownership responsibilities. The campaign would also include a public calendar of educational events. Residents would contact the program through a single phone number and email address, after which liaisons would assess readiness and route participants to education, financial assistance options, or the mortgage application process, including connection to a C&F loan officer and application of any available lender credits.

Next steps

Should the Council decide to move forward, the proposed timeline would consist of five phases. The initial stage this week seeks approval from the City and William & Mary on February 9. Phase 1, running from February 10 through March 31, would focus on team development and completion of defined deliverables. Phase 2, scheduled for April 1-31, would involve the deployment of marketing materials and introduction of the campaign. Phase 3, from May 1 through December 31, would see grants go live, quarterly educational events, and deployment of a marketing content calendar. Phase 4, set for January 2027, would include publishing an outcomes report and confirming continuation of the program.

The writer used AI tools and these sources:

Agenda packet - City Council Work Session to be held Monday, February 9, 2026

Agenda – City of Williamsburg Planning Commission Work Session, Wednesday, January 21, 2026

Bizrate: “Lender credits: What are they and how do they work?”

Investopedia: What Is a 2-1 Buydown Loan and How Do They Work?

Other ways to support the Williamsburg Independent …