GUEST COMMENTARY: City Pushes Forward with Ambitious Building Plan

Despite reduction in requested capital improvement funds, spending still driven by discretionary projects amidst increasing financial uncertainty

(Editor’s Note: This piece contains guest commentary. The opinions expressed below are the authors and not necessarily those of the Williamsburg Independent.)

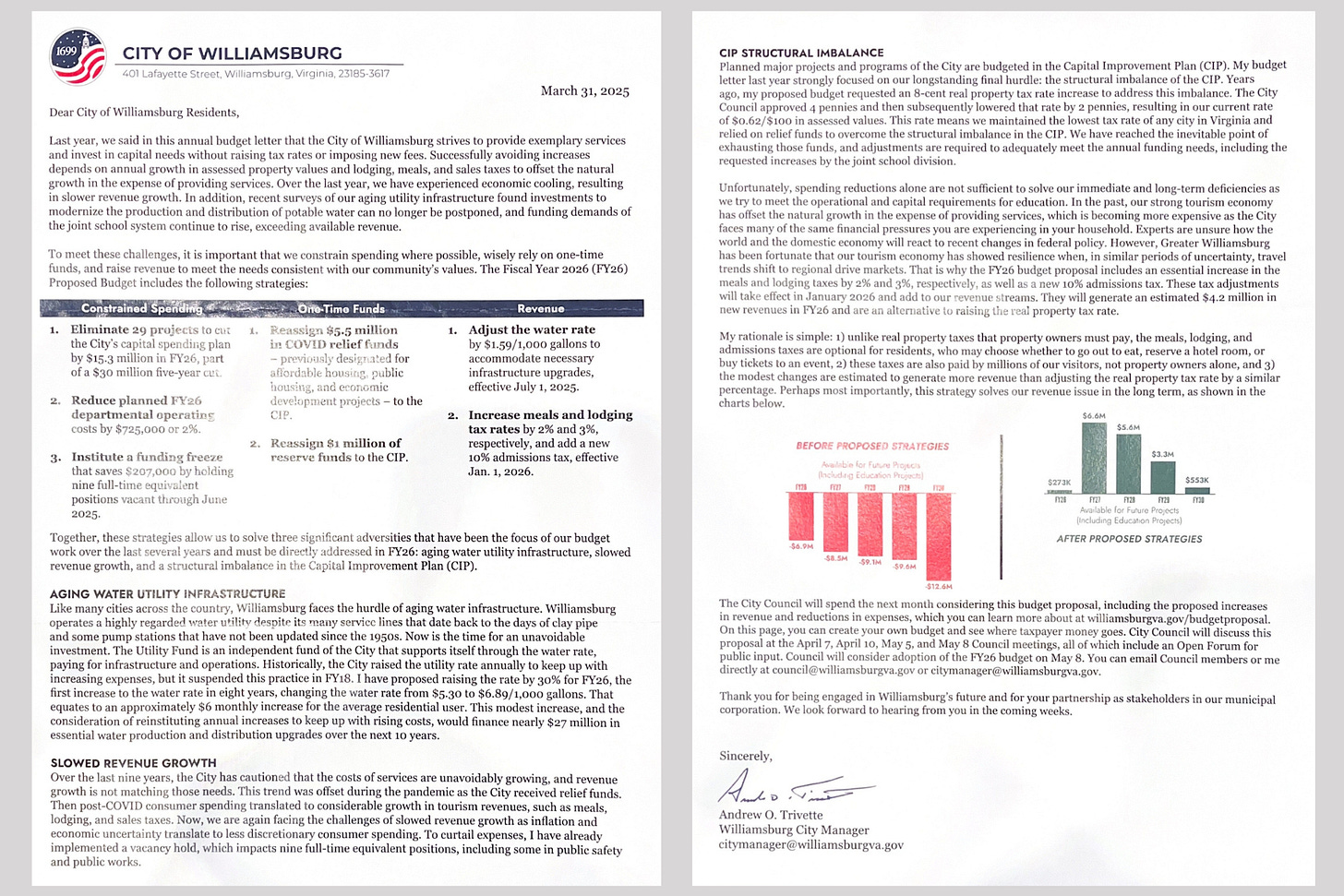

At the end of March, the City of Williamsburg released its proposed FY2026 Budget, which includes a Capital Improvement Plan (“CIP”) consisting of $50M for projects carried forward from the FY2025 Budget, and an additional $38 million for FY2026. Many capital projects extend over a number of years so any funds approved in one year and not spent, are encumbered and able to be spent in future years. Each project will still need separate approval by the City Council to proceed.

While the City intends to keep the property tax rate steady at $.62/$100 in assessed values, they are considering raising other taxes and fees to cover planned capital investments. In a letter recently sent to Williamsburg resident’s, the City Manager, Andrew Trivette, outlined raising the meal taxes by 2%, lodging taxes by 3% and slapping a new 10% tax on admissions (to such attractions as Colonial Williamsburg.) Justifying the new taxes versus raising the property tax rate, the City Manager wrote in the letter that, “The meals, lodging, and admissions taxes are optional for residents, who may choose whether to go out to eat, researve a hotel room, or buy tickets to an event.” The City also expects to significantly raise water rates over the next 10 years in order to pay for needed infrastructure repair and replacement.

The budget timeline provides for residents’ comments on the budget and capital projects during a City Council meeting on Thursday, April 10th. Residents are also encouraged to provide input either during the public comment period during the City Council meetings or by emailing your City Council members council@williamsburgva.com. A vote on the budget by the City Council is slated for May 8th.

Some of the larger proposed capital projects for FY2026 are discussed below.

New Williamsburg library

Last month, the City Council authorized the City to enter into a preliminary agreement for the design and construction of a new library. The proposed FY2026 Capital Budget includes the new library at a total cost of $39.6 million funded by a City General Obligation Bond of $20 million, $15 million from James City County and York County, and $5 million from grants and private donations. The preliminary proposal would locate the new library on the site of the old police station and the current parking lot while demolishing the old library building. Once completed, the new facility will increase annual City operating costs by an estimated $1.4 million.

As reported by the City, “Williamsburg, James City County, and York County jointly fund the Williamsburg Regional Library system through a regional Contract. Under the contract, each jurisdiction pays for the cost of construction for any library building within its borders, and all 3 share the annual operating budget for the library system.”

Questions have immediately risen as both James City County and York County announced their desire to renegotiate the existing contract for the Williamsburg Regional Library, as reported by Digby Solomon in Williamsburg Watch. The jurisdictions stated they seek greater control and a deeper look at how much they each pay. York County has questioned the wisdom of contributing to the cost of the new library proposed for Williamsburg.

Meanwhile in James City County, their FY2026 Capital Budget includes $49.5 million over 3 years for their own new library building to be constructed next to the new government center. Once completed the question arises whether there will be continued interest, or need, for JCC to continue contributing to a joint library system. And even if they do, what will be the added annual operating cost to Williamsburg of both remaining in the regional system or going it alone without the JCC cost participation.

Downtown children’s park

How can you not like a children’s park?! Over the past few years, the City has discussed placing a new children’s park near the library in the municipal district. However, suddenly in January and February, the City proposed placing it on the pastureland on N. Henry Street near the Prince George Street entrance to the Historic District with no discussion or notice to the Peacock Hill community. And as proposed, with a $6.5 million estimated cost, that does not include the cost of acquiring the land from CW, this is not some ordinary Children’s Park. As presented to the City Council at the Budget Retreat, “the Peacock Hill children’s park is designed to include a splash pad that is public art, sand play, climbing centers, slides, and a carousel, all themed to Williamsburg’s historical context and design standards.” It would also include restrooms. Further the City noted “In order to meet the goal of completing the Project by July 2026, Davenport recommends pursuing an interim financing in Spring 2025 via a direct bank loan.”

The FY2026 Capital Budget reflects $3.05 million carryover from last year’s budget and $3.45 million in the FY2026 Capital Budget. The City hopes to defray some of the costs with grants and gifts, though no such funds have yet been secured by the City. There is no mention in the Capital Plan of funding the project through a bank loan.

The park has recently been the focus of protests from local community members concerned with the cost and the location of the park. The pushback may have triggered a reevaluation of the project. That, and as Solomon reported in Williamsburg Watch, Colonial Williamsburg was none too pleased with the new admissions tax. At the City Council meeting yesterday, Williamsburg’s Mayor, Doug Pons, asked Trivette to remove the children's park and related debt from the budget, which may allow the reduction of the admissions tax from 10% to 5%.

Roundabout on Richmond Road

During last month’s City Council meeting, it was reported that the City is seeking to move forward with the project to install a roundabout on Richmond Road at its intersection with Monticello Ave and Lafayette Street. The City had received a VDOT Grant of $6.4 million in 2019; however, the Public Works director reported that costs have increased and the current estimate could exceed $10 million. Without additional grant money, the excess would have to be paid out of the General Fund. The FY2026 Capital Budget includes using $3.6 million of the Grant money to design the project. As noted during the City Council meeting, if the City declines to move forward with the project, any grant monies spent would have to be repaid to VDOT.

Lafayette Street widening

This Project would widen portions of Lafayette Street and add a shared use path to the Municipal Building. Together with improvements to 3 intersections, the City claims the combined improvements would provide an improved arterial pathway for traffic to the new Regional Sports Center and desired CW development adjacent to the Visitor’s Center. The Project has an estimated cost of $6.1 million.

Water and sewer infrastructure

The proposed Capital Plan includes $27.6 million over 10 years to rehab and upgrade the City’s water and sewer infrastructure. I won’t repeat my past commentary about the City’s benign neglect over the years, but the investment is clearly needed as the filtration plant hasn’t received any major upgrade in over 28 years, the ability to process and filter water is significantly below its design capacity, the water system loses over 170 million gallons a year through leaks and evaporation, and increasing demand will overtake our current storage capacity in the near future.

The City has remained silent, and there is no provision in the current budget, for the $18.5 million payment due June 30, 2025, to Newport News Waterworks to retain 1 mgd (million gallons per day) of water supply through 2050. If the City allows this supply to lapse, we will be dangerously exposed to water shortages during drought periods. Without this added 1 mgd supply, the City’s Safe Yield Water supply is currently only 3.67 mgd, while the City’s peak daily demand last June was almost 4 mgd. We’ve seen with climate change that the cycles of rain and drought are increasing. Further with the City’s growth agenda, once current projects that have already been approved around the City are completed and occupied, the City will soon lose its self-sufficiency in its water supply during the peak summer demand. Future development over the next 10 years potentially will result in water demand outstripping our total water supply. Maybe the forthcoming update to the City’s Utility Master Plan will address these concerns.

Next Up: How Debt is Used by the City

The final installment of the Budget Series will look at how the City has used debt to finance the construction of major projects in recent years. On one hand, it spreads the cost of major facilities over a number of future years; but on the other hand, it increases the cost structure of the City through principal and interest payments which are due irrespective of the level of revenues in those years.

Read previous posts in the budget series below:

PART 1 - Rising Residential Real Estate Property Assessments & Increased Spending

PART 2 - Troubling Issues Loom over Williamsburg Budget

PART 3 - Cooling Property Assessments, Increased Costs Push Williamsburg Budget

About the Writer: During a 45-year career, Robert Wilson worked with senior leadership teams to develop and implement innovative strategic and business plans that have fostered growth and profitability. His background includes direct profit and loss responsibility, forging effective multi-functional leadership teams, restoring organizations to sound financial footing, and implementation of best practices initiatives. He has demonstrated a mastery of turnarounds and troubled companies in a variety of business sectors.

Prior to retiring in 2021, Dr. Wilson was Co-COO of a $2 billion operating division of a Fortune 500 Company. He has held the positions of CEO, President, COO, and CFO in several regional and national organizations during his career. Since retiring from corporate life, Mr. Wilson has served as an adjunct instructor in the business school at Christopher Newport University.

Dr. Wilson holds a BBA degree from the College of William & Mary, a MS in Finance degree from the University of Arizona, and a Doctorate in Management from the University of Maryland Global Campus. He is a member of the Beta Gamma Sigma honorary business fraternity. Since 1979, he has held a Certified Public Accounting license in the Commonwealth of Virginia (currently inactive) and is a member of the American Institute of Certified Public Accountants and an original member as a Chartered Global Management Accountant.

Dr. Wilson resides in the City of Williamsburg and may be contacted at wilstar2001@gmail.com.